Great Info For Selecting Credit Card Apps

Wiki Article

How Can I Determine If My Credit Card Were Reported Stolen?

Follow these steps: 1. Contact the credit card company that issued your card.

Contact the number on the back of your credit card.

You may ask the representative to confirm the status of your card.

Prepare your personal information and the details of your credit card to be verified.

Verify Your Online Account

Log into your online bank account or credit card that is linked to the card you're using to refer to.

Keep an eye out for any alerts or notifications which could be related to the status of card.

Examine recent transactions to spot any suspicious or illegal activity.

Keep an eye on Your Credit Report

Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) through AnnualCreditReport.com.

Check for suspicious credit accounts or inquiries on your credit report that might suggest fraud.

Fraud Alerts and Security FreezesSecurity Freezes and Fraud Alerts

It is worth considering putting an alert about fraud or a security freeze on your credit report in case you suspect fraud or identity theft.

A fraud warning warns creditors to the additional actions they must take to verify identity before giving your credit. Meanwhile, a security freeze blocks access to your credit file.

Keep an eye out for any suspicious activities and immediately report any suspicious activity.

Monitor your credit card statements and report any unauthorized transactions or suspicious activity to the credit card company immediately.

If you suspect fraud or identity theft to the Federal Trade Commission. File police reports in your neighborhood.

Contacting the issuer of your credit cards, looking over the activity of your account on your website, monitoring your report and being vigilant for any indications of an unauthorised actions, proactive steps could be taken to safeguard yourself against credit fraud and resolve any potential issues relating to a stolen credit.

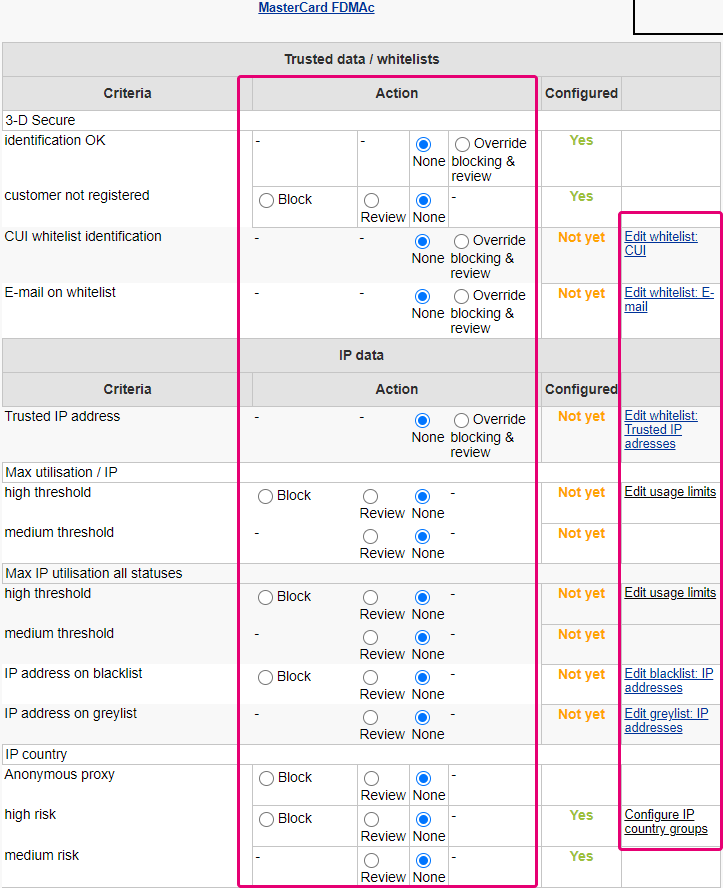

What Is The Meaning Of My Credit Cards Are Listed On A Blacklist?

When a credit card is listed on the blacklist, it generally refers to the credit card being flagged or blocked by the issuer of the card or financial institution due to suspected suspicious activity, security concerns or other factors that could be related to risks.Being on a blacklist indicates that the card is temporarily restricted to certain transactions or use until the issue is fixed or verified by the person who holds it. A card can be put on the "blacklist" due to a variety of reasons. These include:

Card Blocked for Security Reasons - If you suspect fraud, your card may be canceled if the card detects unusual or suspicious transactions.

Security Issues - If there is any evidence of a possible security breach such as unauthorised access, leak of card information or unusual patterns of spending, the card could be tagged.

Identity Verification Problems - Issues in proving the identity of the person who is using the card in transactions could lead to the temporary blocking of the card in particular when an additional verification is required.

Card which has been stolen or stolen - The card issuer can stop the card in the event that the cardholder claims it is lost or stolen. This can stop unauthorized use of the cards until the replacement card is delivered.

Suspicious Activity Indicators - Any behavior or activity which is linked to the card and could raise suspicion can trigger an immediate block. For example, numerous declined transactions, geographic anomalies, or unusual spending patterns.

A card that is listed on the blacklist may limit the cardholder's ability to obtain credit, or to purchase purchases using the card. This could be until the issuer of the card confirms the authenticity of the account or addresses any fraud or security concerns. It is essential that the user to contact the card issuer quickly to resolve any issues, confirm the validity of transactions, and resolve any security issues.

Who Are The People Who Can Examine Credit Card Numbers On An Blacklist?

Financial institutions with authorized professionals or law enforcement agencies as well as cybersecurity firms are typically responsible for validating credit card numbers or checking suspicious activity associated with credit cards. They are Fraud Analysts who are trained individuals in financial institutions that are experts in identifying fraudulent transactions that involves credit cards and analyzing the issue. They use software and tools that are specifically designed to identify patterns and anomalies. They may also discover compromised information about the card.

Cybersecurity experts - Professionals who specialize in the field of cybersecurity. They are able to monitor and spot cyber-attacks, including stolen credit card information. They prevent data breaches by analyzing the data and identifying signs of compromise.

Law Enforcement Officials - Specialized units as well as individuals within law enforcer agencies that investigate financial crime and fraud, such as of credit cards. They have databases and resources they can utilize to monitor and examine fraudulent activity.

Compliance Officers- Professionals in charge of ensuring that they comply with the laws and regulations pertaining to financial transactions. They are also responsible for overseeing procedures for identifying suspicious activities related to credit card.

Access to databases that are blacklisted by credit card blacklists are strictly controlled and requires legal authorization. Examples include being a part of an official investigation into financial crimes, and having specific permissions granted from authorized entities are examples.

They employ protocols, software and legal processes, as well as specific protocols and software to validate credit card details against blacklists, while maintaining strict security and privacy rules. If you're worried regarding the security of your credit card details it's important to speak with authorized professionals or institutions. Access or use that is not authorized of credit card "blacklists" could result in legal implications. Follow the top svastaano cc for site info.